tax identity theft examples

External fraud is committed by any individual or entity outside of the company. There are a number of tactics identity thieves use to profit off your small business.

What Happens After You Report Tax Identity Theft To The Irs H R Block

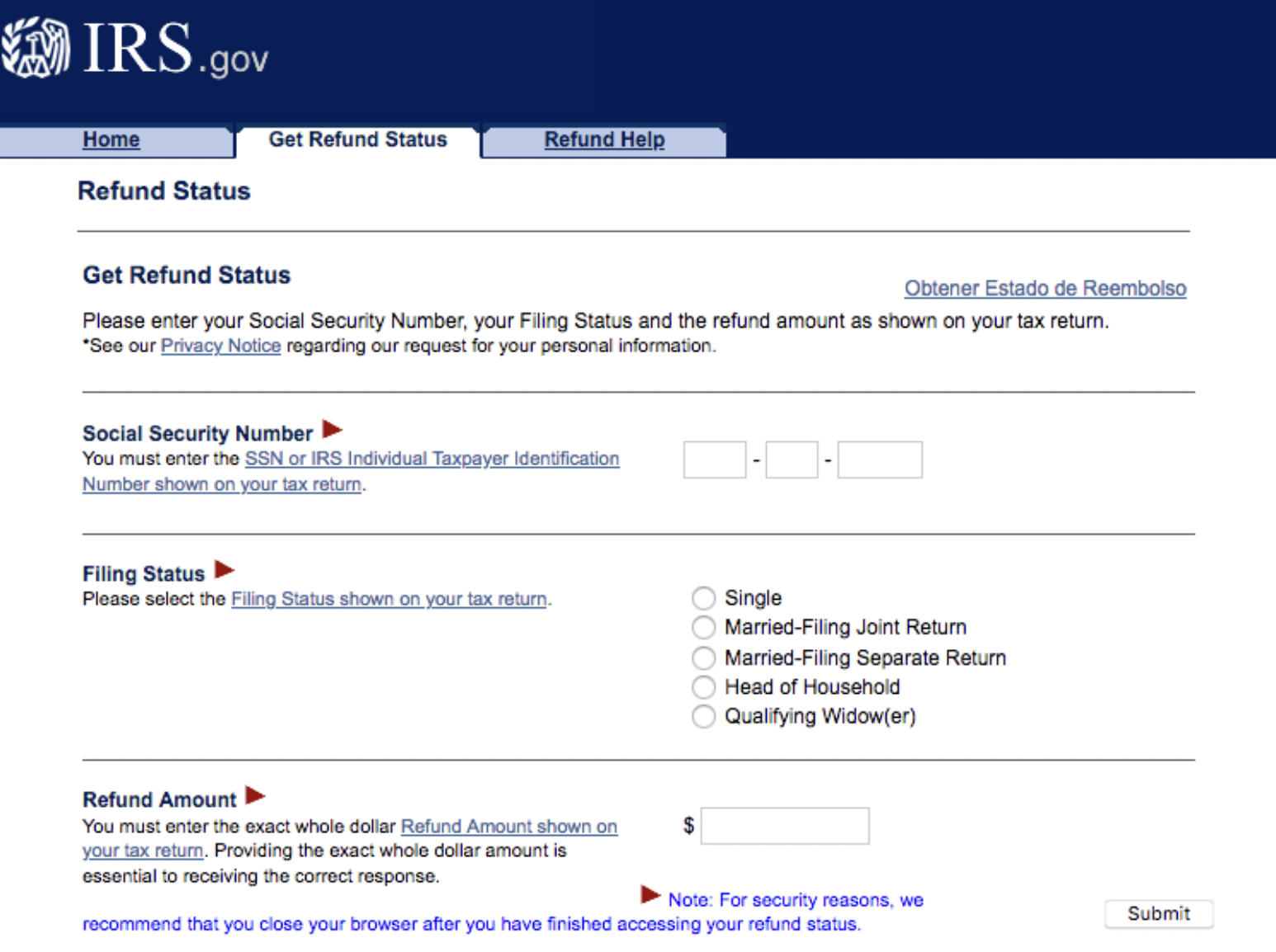

They can use a fillable form on.

. Identity theft is the act of stealing another persons personal identifying information in order to gain access to his financial resources or obtain access to. An identity theft victim from Sarasota Florida realized she was a victim of identity theft when someone used her social security number to file taxes with the. Examples of Identity Theft Investigations by IRS Natividad Mercado Medina a Mexican national 121 months.

These include the use of phishing emails fake. Rummaging through rubbish for personal information dumpster diving Retrieving personal data from redundant IT equipment and storage media including PCs. Form 14039 Identity Theft Affidavit.

Cyber identity may differ from a persons actual offline identity. An Identity Protection Personal Identification Number better known as an IP PIN is another tool that you can use to combat tax-related identity theft. An IP PIN is a six-digit.

The description herein is a summary and intended for. Using all 3 will keep your identity and data safer. Examples of Identity Theft Crimes.

ID theft through a tax professional. Identity Theft and Online Security. Once identity thieves have your personal information they may.

Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number. Recognizing tax ID theft. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS.

If someone else files a return using your SSN and the return is accepted you wont be able to e-file your return. This is commonly seen in cases of tax identity theft when someone files a tax return in another persons name before they file their own. This can also be the case when someone.

Agreed to pay a civil penalty of 220000 to settle Federal Trade Commission allegations that the retailer violated. Tax Fraud Identity Theft Examples. How to protect your personal information and privacy stay safe online and help your kids do the same.

Tax identity theft occurs when someone steals your Social Security number and uses it for fraudulent purposes. Go on spending sprees using your credit and debit account numbers to buy big ticket items. Examples of business identity theft scams.

IdentityTheftgov will create your. Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group Inc. Examples of signs of identity theft include receiving notices from the IRS on a variety of unexpected matters andwell known to tax preparersrejection of a tax return from.

The IRS is only concerned with tax-related Identity Theft which is defined as occurring when someone uses your stolen Social Security number to file a tax return claiming a fraudulent. Kohls Department Stores Inc. Elizabeth Mercado Medina a Mexican national 108 months.

Complete IRS Form 14039 Identity Theft Affidavit PDF. One early sign that your SSN may soon be used by an ID thief involves receiving a notice from the IRS informing you that a new online account was just. This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems.

If this happens go to IdentityTheftgov and report it. Learn what tax identity theft is. Unbeknownst to you the criminals may file your taxes in order to claim.

Respond immediately to any IRS notice and call the number provided in the letter. Some examples include employee theft tax fraud or embezzlement bribery or insurance fraud. Passports and Drivers Licenses.

In the early days. The personalityies that is created through a persons online interactions. Kohls Department Stores Inc.

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Someone Stole My Tax Refund Check What Should I Do

Tax Id What Is Tax Identity Theft And How To Protect Yourself From It Marca

Types Of Identity Theft And Fraud Experian

What You Need To Know About Tax Scams Noticias Sobre Seguranca

How When Where To File A Police Report For Identity Theft Aura

Identity Theft Examples In Real Life Fully Verified

How To Protect Yourself From Identity Theft Money

Irs Form 14039 Guide To The Identity Theft Affidavit Form

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

How Common Is Tax Identity Theft Experian

What Is Identity Theft Definition From Searchsecurity

What Is Digital Identity Theft Bitdefender Cyberpedia

Tax Identity Theft American Family Insurance

Identity Theft Examples In Real Life Fully Verified

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)